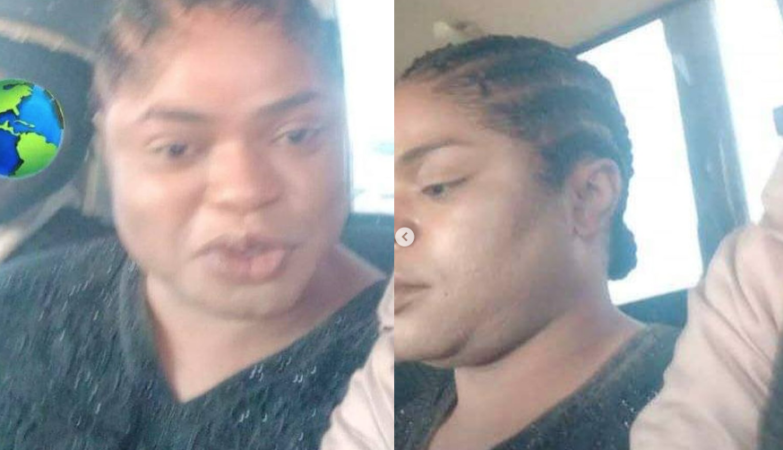

The Economic and Financial Crimes Commission on Monday conducted an on-the-spot raid at the Wuse Zone 4 area of Abuja, arresting an unidentified number of Bureau De Change operators.

BDC operators trading in the area confirmed this to our correspondent stating that the raid happened around noon, causing chaos and fear in the area.

The commission also conducted a raid on Monday afternoon, arresting traders who were only granted bail after paying between N30,000 and N50,000.

The traders who pleaded anonymity due to the sensitivity of the issue said the arrest affected trading activities at the market.

BDC operators arrested as naira weakens to 1,419/$

30th April 2024

The Economic and Financial Crimes Commission on Monday conducted an on-the-spot raid at the Wuse Zone 4 area of Abuja, arresting an unidentified number of Bureau De Change operators.

BDC operators trading in the area confirmed this to our correspondent stating that the raid happened around noon, causing chaos and fear in the area.

The commission also conducted a raid on Monday afternoon, arresting traders who were only granted bail after paying between N30,000 and N50,000.

The traders who pleaded anonymity due to the sensitivity of the issue said the arrest affected trading activities at the market.

7.5M

1.2K

Ojú Kálé: Àwọn Ọmọ Nàìjíríà Fi Èrò Wọn Hàn Nípa Ikú Whitney Adéníran, Ọmọ Ilé-ìwé Chrisland College

He said, “EFCC just raided the market, arresting many operators. They arrested some persons seen on the street and even pursued some persons to their offices. We are still looking for N30,000 or N50,000 to bail those arrested on Friday yet they came again today.”

The development was part of ongoing efforts by the EFCC and the CBN to restore exchange rate stability and boost forex liquidity.

Last Friday, the EFCC in a statement said it arrested 34 suspected currency speculators for alleged foreign exchange fraud.

Despite these efforts, the naira began the week on a negative note against the United States dollar closing at N1419.11/$ on Monday indicating signs of a turbulent week.

At the official market on Monday, the naira traded at a loss, depreciating by N58 or 4.3 per cent from N1,361 it traded last Friday to N1,419 on Monday.

This decline indicates high demand for the greenback note.

The intraday high closed at N1,451 on Monday from N1,410 per dollar on Friday. The intraday low also appreciated to N1,060 on Monday from N1,051 per dollar quoted on the spot trading on Friday.

While an FX transaction worth $147.83m was sold.

Following a consistent climb to N1,120/$1 over 14 days ending on April 19th, from a previous rate of N1,470/$1 on March 25th, the Naira underwent a six-day depreciation, dropping by N310 or 21.68 per cent, and settling at N1,430/$1 by April 26th.

This downward trend reversed at the end of the trading week, with the naira recovering by 2.14 per cent and gaining an additional 3.70 per cent by Monday.

https://googleads.g.doubleclick.net/pagead/ads?gdpr=0&us_privacy=1—&gpp_sid=-1&client=ca-pub-7167863529667065&output=html&h=169&slotname=7613074554&adk=2093647431&adf=595818934&pi=t.ma~as.7613074554&w=676&fwrn=4&lmt=1714475923&rafmt=11&format=676×169&url=https%3A%2F%2Fpunchng.com%2Fbdc-operators-arrested-as-naira-weakens-to-1419%2F&wgl=1&uach=WyJXaW5kb3dzIiwiMTAuMC4wIiwieDg2IiwiIiwiMTI0LjAuNjM2Ny45MSIsbnVsbCwwLG51bGwsIjY0IixbWyJDaHJvbWl1bSIsIjEyNC4wLjYzNjcuOTEiXSxbIkdvb2dsZSBDaHJvbWUiLCIxMjQuMC42MzY3LjkxIl0sWyJOb3QtQS5CcmFuZCIsIjk5LjAuMC4wIl1dLDBd&dt=1714477298324&bpp=4&bdt=1114&idt=368&shv=r20240425&mjsv=m202404240101&ptt=9&saldr=aa&abxe=1&cookie=ID%3D92189e437891b1ea%3AT%3D1712609005%3ART%3D1714477162%3AS%3DALNI_MaN9z89vGdr7FHqi-r5M6Ih0Yartg&gpic=UID%3D00000c0e3cb9d9a9%3AT%3D1683013523%3ART%3D1714477162%3AS%3DALNI_Ma6Q_T3AGomT_UnkVVNzMhf1x8swQ&eo_id_str=ID%3D0ed976eb1efee5e4%3AT%3D1706615081%3ART%3D1714477162%3AS%3DAA-AfjYqq8OTicuDuiDbGRc7lWLS&prev_fmts=0x0&nras=1&correlator=8336656175228&frm=20&pv=1&ga_vid=926964390.1645118806&ga_sid=1714477299&ga_hid=1827032997&ga_fc=1&rplot=4&u_tz=60&u_his=3&u_h=768&u_w=1366&u_ah=728&u_aw=1366&u_cd=24&u_sd=1.1&dmc=4&adx=165&ady=3039&biw=1226&bih=583&scr_x=0&scr_y=0&eid=44759876%2C44759927%2C44759837%2C42531706%2C95329717%2C95329831%2C31083150%2C95331043%2C95331555%2C31078663%2C31078665%2C31078668%2C31078670&oid=2&pvsid=3627433525450336&tmod=1698012837&uas=0&nvt=1&ref=https%3A%2F%2Fpunchng.com%2F&fc=1920&brdim=0%2C0%2C0%2C0%2C1366%2C0%2C1366%2C728%2C1242%2C583&vis=1&rsz=%7C%7Cpebr%7C&abl=CS&pfx=0&fu=128&bc=31&bz=1.1&td=1&psd=W251bGwsbnVsbCxudWxsLDNd&nt=1&ifi=2&uci=a!2&btvi=1&fsb=1&dtd=558

In the official market, the naira exhibited a similar pattern, depreciating by N169.24 or 12.64 per cent to close at N1,339.23/$1 on April 26th, down from N1,169.99/$1 on April 19th, and continuing to decline over the next seven trading days at the NAFEM window.

Currency traders at the popular Zone 4 market said they sold the dollar at N1,340 per dollar, from N1,275 over the weekend.

A trader Abubakar Taura said he bought the dollar at the rate of N1,305 and sold at N1, 340 leaving a profit margin of N25.